The Kingdom of Saudi Arabia is at the forefront of digital transformation, and one of the significant advancements in this journey is the implementation of e-invoicing. The Saudi Arabian government, through the Zakat, Tax and Customs Authority (ZATCA), has mandated e-invoicing to streamline tax collection, improve compliance, and foster transparency in business transactions. This comprehensive guide will walk you through the essential aspects of e-invoicing in Riyadh and help your business adapt to this critical change seamlessly.

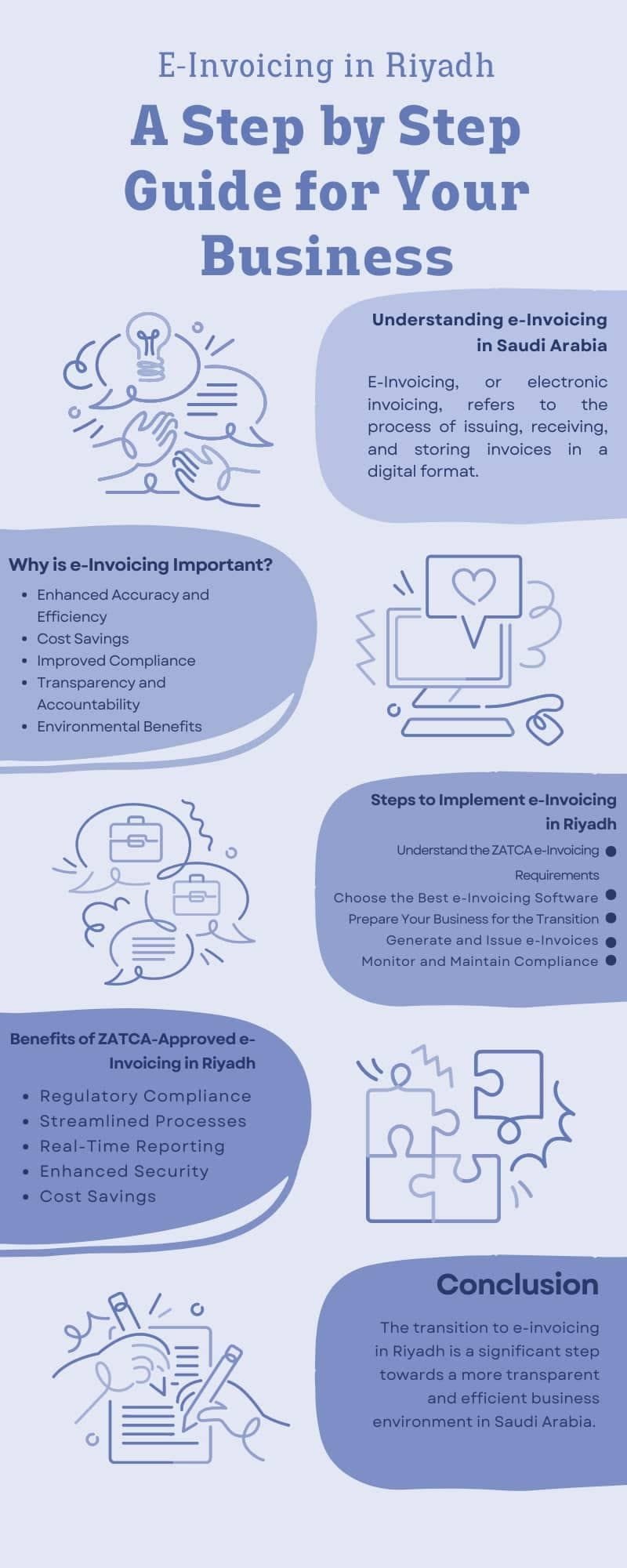

Understanding Riyadh E-Invoicing

E-Invoicing, or electronic invoicing, refers to the process of issuing, receiving, and storing invoices in a digital format. Unlike traditional paper-based invoices, e-invoices are generated, exchanged, and archived electronically, eliminating the need for manual intervention and reducing errors. In Saudi Arabia, the e-invoicing mandate by ZATCA aims to combat tax evasion, enhance economic efficiency, and create a more transparent business environment.

Why is e-Invoicing Important?

The transition to e-invoicing in Saudi Arabia brings several benefits to businesses and the economy as a whole:

1. Enhanced Accuracy and Efficiency: e-Invoices minimize human errors and automate the invoicing process, leading to faster and more accurate transactions.

2. Cost Savings: By eliminating the need for paper, printing, and postage, businesses can significantly reduce operational costs.

3. Improved Compliance: e-Invoicing ensures that all transactions are recorded accurately, making it easier for businesses to comply with tax regulations.

4. Transparency and Accountability: The digital nature of e-invoices provides a clear audit trail, enhancing transparency and reducing the risk of fraud.

5. Environmental Benefits: Reducing paper usage contributes to environmental sustainability by lowering the carbon footprint.

Steps to Implement Riyadh E-invoicing

Implementing e-invoicing in your business involves several steps. Here is a step-by-step guide that will assist you traverse the process:

Step 1: Understand the ZATCA e-Invoicing Requirements

The first step is to familiarize yourself with the ZATCA e-invoicing requirements. ZATCA has outlined specific guidelines and standards that businesses must adhere to when issuing e-invoices. These include:

1.Mandatory Fields: Ensure that your e-invoices contain all the required fields, such as buyer and seller details, invoice date, VAT number, and line item details.

2. XML Format: e-Invoices must be generated in the prescribed XML format to ensure compatibility with ZATCA’s systems.

3. Digital Signature: e-Invoices must be digitally signed to ensure authenticity and integrity.

4. Archiving: Businesses are required to store e-invoices electronically for a specified period.

Step 2: Choose the Best e-Invoicing Software

Selecting the best e-invoicing software is crucial for a smooth transition. Look for the best ZATCA approved e-invoicing in Riyadh that meets all regulatory requirements and offers the following features:

1.Compliance: Ensure the software complies with ZATCA’s guidelines and supports the mandatory fields and XML format.

2. Integration: The software should integrate seamlessly with your existing accounting and ERP systems.

3. User-Friendly Interface: A user-friendly interface will make it easier for your team to generate and manage e-invoices.

4. Security: Look for software that offers robust security features, including data encryption and digital signatures.

5. Support and Training: Choose a vendor that provides comprehensive support and training to help your team get up to speed with the new system.

Step 3: Prepare Your Business for the Transition

Before implementing e-invoicing, it’s essential to prepare your business and employees for the transition. Here are some actions to think about:

1.Training: Conduct training sessions for your accounting and finance teams to familiarize them with the new e-invoicing system and processes.

2. Data Migration: Ensure that all your existing invoices and customer data are migrated to the new system accurately.

3. Testing: Conduct thorough testing to identify and resolve any issues before going live with e-invoicing.

4. Communication: Inform your customers and suppliers about the transition to e-invoicing and provide them with any necessary instructions or guidelines.

Step 4: Generate and Issue e-Invoices

Once your e-invoicing system is set up and tested, you can start generating and issuing e-invoices. Follow these steps to ensure compliance with ZATCA’s requirements:

1.Create the e-Invoice: Use your e-invoicing software to generate the e-invoice in the prescribed XML format. Ensure that all mandatory fields are included, and the invoice is digitally signed.

2. Send the e-Invoice: Send the e-invoice to your customer electronically. Ensure that the invoice is delivered securely and received by the correct recipient.

3. Archive the e-Invoice: Store the e-invoice electronically in a secure and compliant manner. Ensure that the invoice is easily accessible for future reference and audits.

Step 5: Monitor and Maintain Compliance

After implementing e-invoicing, it’s essential to continuously monitor and maintain compliance with ZATCA’s requirements. Here are some actions to think about:

1.Regular Audits: Conduct regular internal audits to ensure that all e-invoices are generated, issued, and archived in compliance with ZATCA’s guidelines.

2. Stay Updated: Keep yourself informed about any updates or changes to ZATCA’s e-invoicing regulations and ensure that your e-invoicing system is updated accordingly.

3. Feedback and Improvement: Gather feedback from your team and customers to identify any areas for improvement in your e-invoicing process and make necessary adjustments.

Benefits of ZATCA Approved e-Invoicing in Riyadh

Adopting a ZATCA approved e-invoicing in Riyadh offers numerous benefits for your business:

1. Regulatory Compliance: Ensure your business complies with ZATCA’s e-invoicing regulations, avoiding penalties and fines.

2. Streamlined Processes: Automate and streamline your invoicing processes, reducing manual effort and errors.

3. Real-Time Reporting: Benefit from real-time reporting and validation of invoices, enhancing transparency and accuracy.

4. Enhanced Security: Protect your invoices from tampering and unauthorized alterations with tamper-proof security features.

5. Cost Savings: Save on printing, postage, and storage costs by eliminating paper-based invoices.

Conclusion

The transition to e-invoicing in Riyadh is a significant step towards a more transparent and efficient business environment in KSA. By understanding the ZATCA e-invoicing requirements, choosing the right e-invoicing software, and preparing your business for the transition, you can ensure a smooth and compliant implementation. Embrace the benefits of e-invoicing, such as enhanced accuracy, cost savings, and improved compliance, and position your business for success in the digital age.