Home Affordability

In recent discussions, home affordability challenges have been at the forefront. While it’s undeniable that affordability remains a concern, promising indicators are suggesting an easing of the situation, with potential improvements on the horizon.

Elijah de la Campa, Senior Economist at Redfin, shares insights:

“We’re gradually emerging from an affordability setback, though there’s still ground to cover. Mortgage rates have shown a decline from their peak and are anticipated to decrease further by year-end, potentially enhancing homebuying affordability and encouraging more activity in the market.”

Let’s delve into the latest data on the three primary factors influencing home affordability: mortgage rates, home prices, and wages.

1. Mortgage Rates

Mortgage rates have exhibited volatility throughout the year, fluctuating within the upper 6% to low 7% range, which is notably higher compared to previous years. However, there’s a glimmer of positivity amidst this. Despite recent fluctuations, rates remain lower than last fall’s peak of nearly 8%. Additionally, industry experts anticipate a gradual decline in rates over the coming months. According to a recent analysis by Bright MLS:

“Expectations point towards a decline in rates during the latter half of 2024, though they are projected to stay above 6% this year. Even a modest decrease in rates is anticipated to stimulate both buyer and seller activity in the market.”

Even a slight dip in rates can significantly impact affordability. Lower rates translate to more manageable monthly payments, facilitating access to preferred housing options.

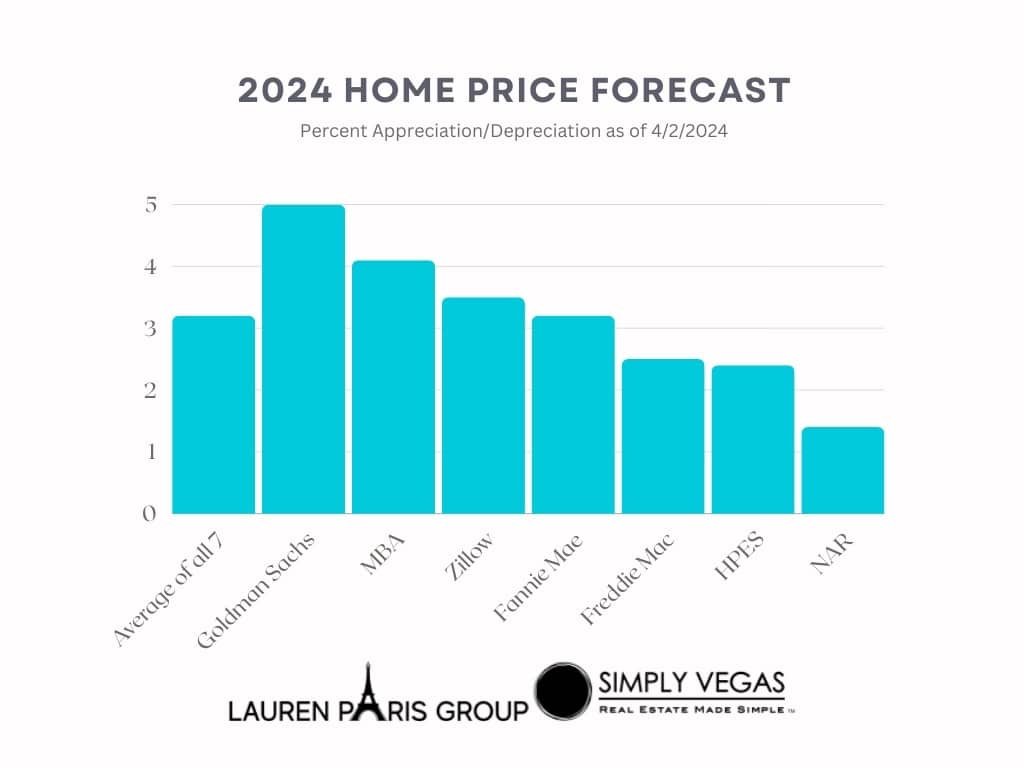

2. Home Prices

Another pivotal factor to consider is home prices. Forecasts indicate a continued upward trajectory throughout the year, albeit at a more sustainable pace. This is attributed to the increased inventory of homes available for sale, though demand still outstrips supply. Projections from various organizations for 2024 depict a reassuring trend, suggesting that prices are unlikely to experience the drastic spikes witnessed during the pandemic era. While prices are anticipated to rise, the pace of growth is expected to be more moderate.

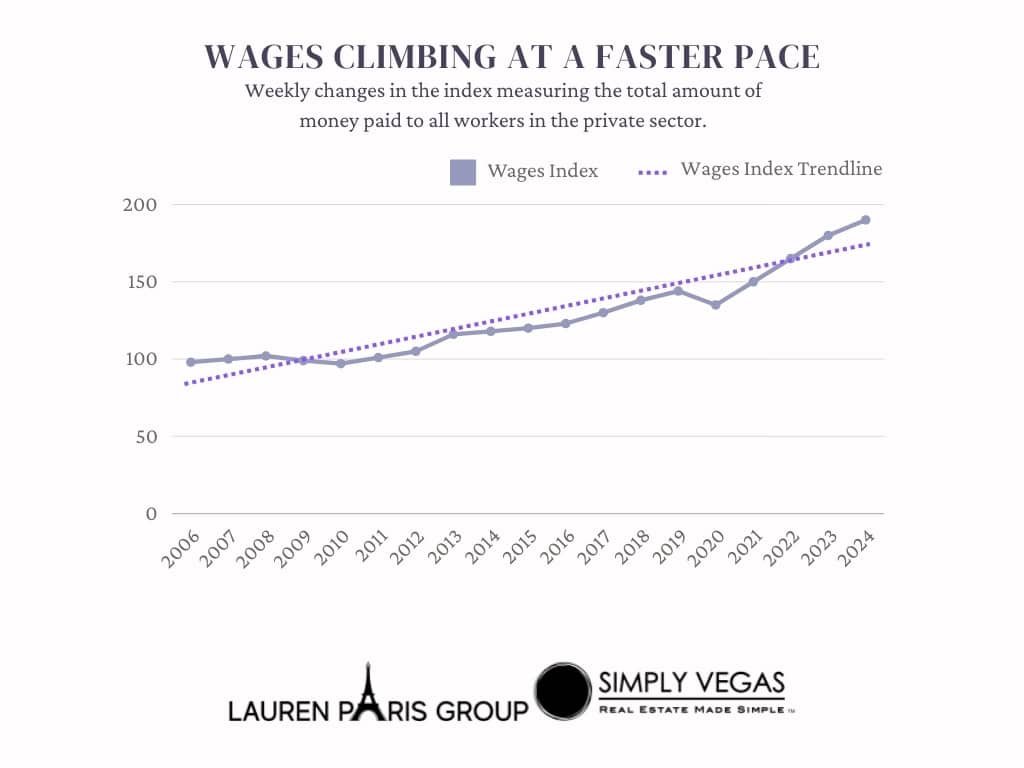

3. Wages

One of the main reasons for the current affordability dynamics is the increasing trend in wages. According to data from the Federal Reserve, there has been a significant increase in wages, surpassing the typical growth rates. This upward trend in wages results in increased affordability, as having a larger income buffer helps to reduce the burden of monthly mortgage payments.

Bottom Line

Considering these factors collectively, there’s a promising outlook for prospective homebuyers. Projections indicate a potential reduction in mortgage rates, coupled with a tempered rise in home prices and accelerated wage growth.

These trends bode well for improving home affordability, offering encouraging prospects for individuals seeking to enter the housing market.